Surf Report 9.2-4: The "Endless Summer" in Precious Metals and Miners

Senior Gold Producers, GDX Part 4

In Surf Report 9.4-3 we learned who the best male surfer is in 2024. So again I would like to provide fair treatment of the subject and introduce y’all to the best female surfer of 2024. Caroline Marks won the gold medal at the Paris Olympics and was a very close second in the 2024 World Surf League Tour Championships after earning the top spot in the 2023 WSL Championships. During the 2023 season, Marks recorded six podium finishes and three wins on the Championship Tour and is the youngest woman to compete in a World Surf League event when she started competing professionally in 2018. Her surfing style is a combination of raw power and elegant grace. Let’s take a look at Caroline’s incredible surfing skills she displayed 5 years before she won Olympic gold.

There are so many things that are out of your control when you surf and I think you have to focus on the things you can control.

-Caroline Marks

Those are some words of wisdom that Miss Marks has which should also be applied to Elliott Wave Surfing. As I’ve stated before in previous Surf Reports, we cannot control what happens within irrational, nonlinear financial markets. You may think that a particular stock or asset will keep going in the direction you want forever but all of a sudden market sentiment changes from one or more catalysts and the waves you are surfing become more volatile and it feels like you are headed for a wipe out. Focus on what you can control. Are you overallocated and taking on too much risk in a particular asset, sector, or stock? Are you using too much leverage? Are you able to control your emotions when price pulls back in a Minor degree wave 4 within a larger Intermediate wave (3) when your intention was to sell at the larger degree targets? It is my personal view that those who cannot control their emotions or understand their own personal risk tolerance have no business managing their own investments with money they can’t afford to lose. As Elliott Wave surfers, we must use Elliott Wave counts to observe and take advantage of market sentiment, not to become participants controlled by our own changes in sentiment.

We certainly have seen some changes in sentiment in the Precious Metals and Miners sector these last few weeks haven’t we? Price is a powerful influence on sentiment and as the prices of gold, silver, and the miners have consolidated during the past month, I’ve seen less and less bullishness on X and other social media platforms. I’m sure some readers are even wondering whether the bull market in metals and miners is over already. Well as you’ll see in this report that could be nothing further than the truth. Let’s get to it. For this report we will also continue our review of Senior Gold Producers within the VanEck Gold Miners Equity ETF (GDX). We’ve already covered many of the charts in this next group of GDX holdings within other Surf Reports for GDXJ in Surf Report 9.4-1, 9.4-2 and 9.4-3. Once again we’ll update near term charts for holdings that are repeated which will be the majority of this report. I have two new charts to show you which have not been covered in any previous report.

GDX update

First lets take a look at GDX and complete an update there. I’m now in the camp that we've seen a Minuette wave (iii) complete within Minor degree 3 with a deep wave (iv) retracement. Although prior support at $36.22 broke, price quickly recovered and has the potential to get 5 waves up to begin wave (v) of 3. The rally in GDX is not over yet as we can see in the Minor degree count, however a break below the wave (ii) low or $32 would invalidate the Minuette degree count I’m showing here.

Equinox Gold Corp (EQX.TO)

We first looked at the larger degree wave structure in EQX.TO in Surf Report 9.4-2 so now we’ll zoom in to see how Minor wave 3 (or perhaps Wave C) is progressing. We can see from the 144-min chart that price still struggling to break out from overhead Fib resistance within Minor degree 3 but its a great sign that support has not broken and the (i)-(ii) count remains valid. The larger uptrend remains in place and the remainder of Wave 3 can prove to be explosive once resistance is broken.

Perseus Mining Ltd (PRU.TO)

In Surf Report 9.4.2 we also looked at the larger degree count in PRU.TO. There we saw that price had broken out from Minor degree Fib resistance. As we can see from the 144-min chart, Minor degree Fib support has remained intact following the breakout but there is still some work to do to complete wave (v) of 3. I’m looking for some some higher extensions to potentially take place for (v) of 3 given the strength that we saw in wave (iii).

Oceanagold Corp (OCG.TO)

We observed a pretty massive bull flag in the longer term chart for OCG.TO in Surf Report 9.4.3. Although not shown in the 6-hr chart below, the breakout level of the bull flag was around the $5 level. Based on the smaller degree wave structure, that level should be breeched once the full 5-wave structure completes for Minute wave c of Minor degree C. Price has shown strength rising strongly through Minuette degree Fib resistance that has all the characteristics we would expect at the heart of a wave (iii). There is still a bit more structure to complete wave (iii) but notice that negative divergence is appearing on the MACD which portends a consolidation wave (iv) is around the corner once (iii) completes.

New Gold Inc (NGD)

We also looked at the larger degree count in NGD in Surf Report 9.4.3 when we saw that price was clearly heading higher in a Minor degree wave 3. We will now need to zoom into the 144-min chart to see how close Minor wave 3 is to completing. Within Minor degree 3 we would expect to see a 5-wave structure as well and that is what appears to be happening with enough wave structure complete to consider that Minuette wave (iii) completing in late September with wave (iv) now underway. Recall that wave 4s typically retrace to the 38.2% Fib level so wave (iv) may have a bit more to go before a local low is achieved.

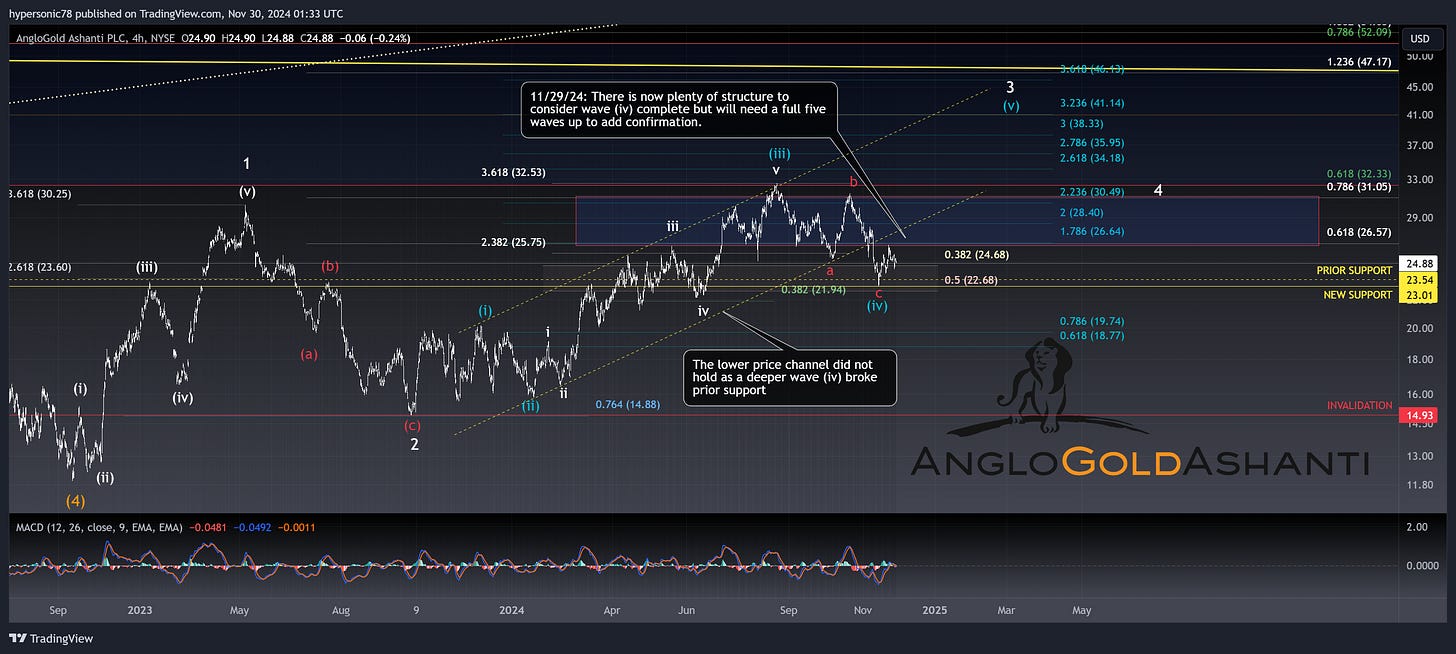

Anglogold Ashanti (AU)

This section of this Surf Report was originally intended to show an update on Centamin PLC since it was previously listed as a top 30 holding in GDX. However while finalizing this report, I discovered that Anglogold Ashanti completed its acquisition of Centamin PLC on November 22, 2024. Therefore we’ll do an update on AU which was first reviewed in Surf Report 9.2-2 where we observed an Intermediate wave (5) was underway. Intermediate (5) continues to make progress as shown in the 4-hr chart below. Minuette (iv) retraced a litter deeper than is typical for a wave 4 as price broke below the lower trendline of a price channel for Minor wave 3 of (5). We should expect one more wave higher before we can consider Minor wave 3 as being complete despite the break in the price channel.

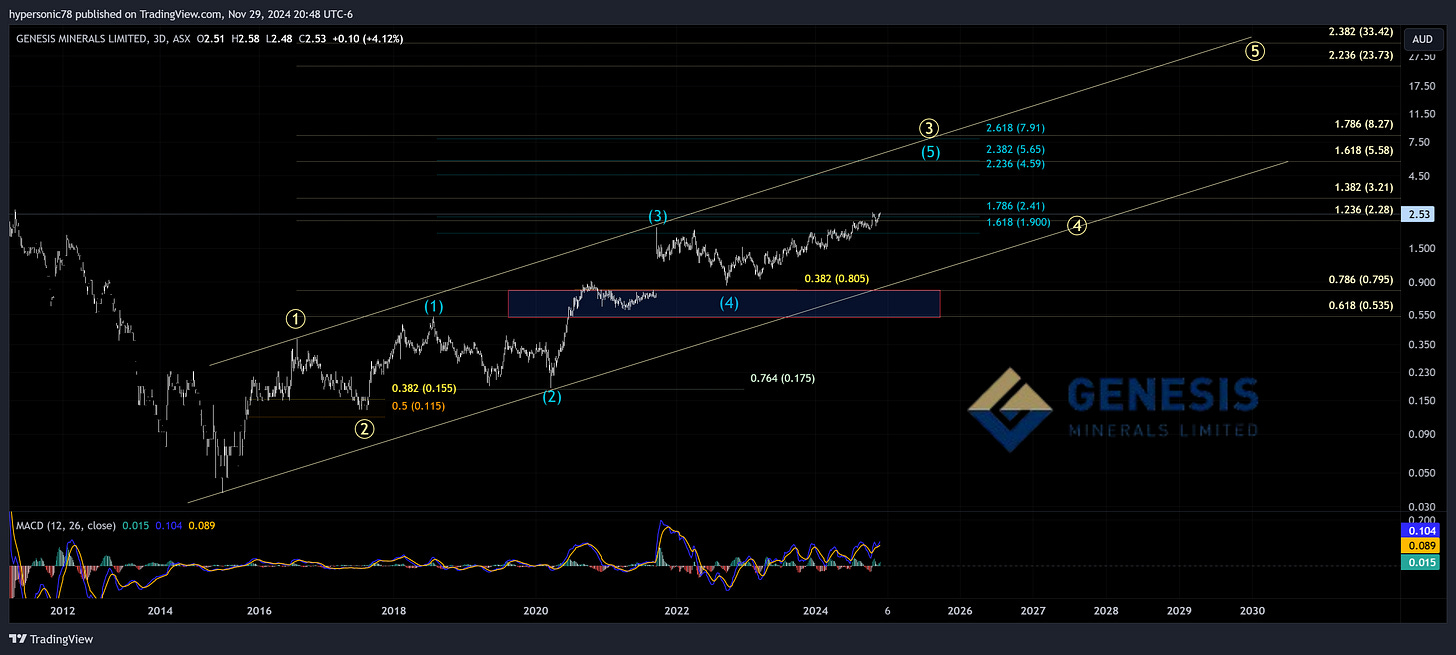

Genesis Minerals Ltd (GMD.AX)

Our first new chart is Genesis Minerals Ltd which is an Australian gold mining company that engages in the exploration, production, and development of gold deposits in Western Australia. The company is currently focused on operations in the Leonora and Laverton districts. Looking at the 3-day chart we see the larger degree wave structure is forming a standard 5-wave impulse in the Primary degree with price now attempting to complete Intermediate wave (5) within Primary wave 3. Since Intermediate wave (3) extended to the 1.618 Fib level, its reasonable to expect that Intermediate wave (5) will also extend a bit higher towards the 2.236 level coincident with the 1.618-1.786 Primary Fib extension. This chart also is obeying a clear multi-year up trending price channel.

First Majestic Silver (AG)

AG joins PAAS, BVN, HL, and CDE as being top holding in all Precious Metal Mining ETFs were are reviewing within the Endless Summer series. We last reviewed the smaller degree counts in Surf Report 9.4.3. With the recent price consolidation from the late October highs, I am now tracking two separate counts for the underlying structure within Minute wave C (or possibly Minute wave iii). There is a potential that the recent consolidation is actually a Subminuette wave iv within a larger 5-wave diagonal. Both counts are looking for the surf to be “up” and since AG is showing positive divergence on the MACD, I don’t believe it will be much longer until we see price reverse higher to complete a Minor wave A or Minute iii within an even larger diagonal.

Torex Gold Resources Inc (TXG.TO)

Torex Gold is currently Mexico’s largest gold producer and a leading Canadian intermediate gold mining company engaged in mining, developing and exploring its 29,000 hectare Morelos Gold Property in the Guerrero Gold Belt in Mexico. Looking at the larger degree count on the 3-day chart, price made an all time low in 2009 and rallied over 3800% to its ultimate extended (B) wave high achieved in September 2016. I’m counting several 3-wave structures in the long term count and believe that price is now in either an Intermediate (1) or (A) wave within a Primary C that will take several years to complete. TXG.TO appears to have a decent shot at making new all time highs at Minute wave c, of Minor wave C completes but notice that the MACD is now signs of slowing momentum.

Summary

As we can see from this group of GDX holdings. the rally in gold and silver miners has yet to reach it completion. The consolidation we’ve experienced in the last month should be viewed as typical within a larger degree uptrends. A few of the charts we’ve we’ve reviewed in this report such as EQX.TO, PRU.TO, NGD, and AU still need more wave structure to consider their respective Minor degree wave 3s as being complete. Once again we are reminded that its important to remember the larger degree trends that are in place even though smaller degree consolidation waves are being seen. Don’t get thrown off your gold and silver miner Elliott Wave surfboard’s too soon. We’ve now completed reviewing 31 of 57 holdings in the GDX ETF and are over halfway there in reaching our goal of reviewing them all. Four more GDX Surf Reports should do the job at the current pace. Believe it or not we’ve now charted 89% of GDX’s holdings on a weighted basis. The remaining 30 or so companies we will chart will each represent less than 0.5% of GDX, and contribute far less to GDX’s overall price movement. Maybe we’ll find a few standout waves to ride that aren’t as far along in their wave structures before the overall GDX Primary wave is complete.

I hope you enjoyed this Surf Report! In Surf Report 9.3-4 we will once again revisit the SIL ETF and cover the next batch of holdings within that fund. Despite wintertime being in our midst in northern hemispheres, we still aren’t done with our Endless Summer in precious metals and miners by any extent.

Until next time…

Cheers and #EndTheFed!

-Hypersonic78

Disclaimer: None of this is financial advice! Please do your own diligence. The views expressed here and other Surf Reports are my own. Only risk what you can afford to lose in these crazy markets. Know your timeframes, parameters, and personal risk tolerance.

Position Disclosure: I remain long physical silver and gold (mostly silver) and am long AG which was reviewed in this report as well as a handful of other individual precious metals mining shares not listed here.

Premium Content…

Keep reading with a 7-day free trial

Subscribe to Hypersonic Elliott Wave Surfer to keep reading this post and get 7 days of free access to the full post archives.