Surf Report 9.2-2: The "Endless Summer" in Precious Metals and Miners

Senior Gold Producers, GDX Part 2

Back by popular vote! Once again thank you for participating in our recent poll. In second place came interest in the Uranium sector so we will begin revisiting stocks within the URA ETF again in the near future. For now though, let’s continue with another short surfing history lesson before we proceed with our own “Endless Summer” in Precious Metals and Mining.

When it comes to surfing nature’s ocean waves, I would be remiss if I didn’t mention Kelly Slater who is hands down the greatest surfer of all-time. Slater was crowned World Surf League champion a record 11 times and also holds 56 Championship Tour victories. Slater revolutionized surfing with aerial moves the likes of which had never been seen before in the sport. Slater is not just surfing these waves, he is flying on them!

People look at the ocean that don't know anything about it like that's crazy-looking, but once you put yourself in this situation, you realize there's a flow to everything.

-Kelly Slater

I know there are many people who look at the financial markets and don’t know anything about them. They will passively invest or hire an advisor. Which is fine. Investing and trading on your own is not for everyone. Furthermore there are many who do have an idea how markets may work but actually don’t understand the real reasons a stock or asset rises and falls as they do other than there were more buyers than there were sellers or vice versa. Or maybe it was some news event they will blame for a particular price movement. They will look at a few stock charts and say “geez that’s crazy looking” while they ask themselves when or if they should buy a particular stock. They may buy a stock based on a recommendation from their friend or what they read in a financial article or on Reddit about the fundamentals. Or maybe they were convinced by something they saw on a financial TV show or YouTube channel. Or they may buy it because others are and the stock happened to be rising at the time and they didn’t want to miss out on those gains. Or maybe they are selling a stock because it has started to fall and they feared losing their investment. I certainly hope these folks aren’t just buying a particular stock because a random account on X with a profile pic showing a surfing gorilla is interested in it, or any other random account for that matter. A lot of trading and investment is caused from our emotions.

But what if there is a better way to decipher which stock or asset is buy or sell (and most importantly at what price)? What if we can understand what’s really driving the seemingly random rise and fall of asset prices from minute-to-minute, hour-to-hour, day-to-day, week-to-week, month-to-month, year-to-year, and yes, even decade-to-decade? To obtain this deeper comprehension, it’s important to understand how sentiment works and that our brains are hardwired to follow the herd into and out of financial assets based on our emotions to satisfy an instinctive and innate need to survive. Elliott’s waves work within those irrational emotions and behavior to identify areas of support, resistance, and general trends. Further we should understand that Elliott’s waves are fractal in nature and self-similar in varying degrees of time. The same types of patterns repeat again and again on both short and long timeframes. Once we understand how all those items fit together, then we will realize there is a flow to everything in the financial markets, and that flow can be captured with Elliott’s Waves. I highly recommend if you want to understand more deeply how social mood, emotion, and sentiment effects the financial markets and our own behaviors within them, there is a book called The Socionomic Theory of Finance by Robert Prechter I think you should read and study. I read it several times and there are so many gold nuggets in there.

Speaking of gold nuggets, let’s return to look at more Senior Gold Producers and review the next group of holdings within the VanEck Gold Miners Equity ETF (GDX). We’ve already covered many of the charts in this next group of GDX holdings within other Surf Reports for SIL, GDXJ, and SILJ. For those charts we’ve recently covered, we’ll complete more near term analysis in this report We do have three new stocks we’ll take a look at in the longer term, larger degree view. Grab your board.

Anglogold Ashanti (AU)

Anglogold Ashanti is a chart I’ve never looked at before this Surf Report. As of 2023, AU is the world’s fourth-largest gold miner with assets in Ghana, Australia, the US and Argentina. The company produced 2.635Moz of gold and 3.6Moz of silver as a by-product from operations in 2023. As far as the chart is concerned it greatly reminds me of the Hecla chart with a massive multi-decade long downtrend that its now challenging to finally break out of. This downtrend trendline just happens to lie between the 0.618-0.786 Fib extension resistance from Cycle I-II. Will it have a “false breakout” to complete a full 5 wave intermediate structure before a Primary 2 retests longer term investors faith? I’ve shown a very deep Primary 2 down to the 61.8% level but it certainly doesn’t need to retrace that low and can be much shallower. We wont know until a few years from now.

Kinross Gold Corp (KGC)

We last reviewed the KGC chart in Surf Report 9.4-1 published about a month ago. There we did an update on the larger degree view so let’s zoom in a bit more to see how far along Wave C of (1) may be progressing. The structure fits best as 3 wave ABC diagonal where wave (iii) of C of what could be an intermediate (1). We should expect a wave (iv) pullback before we get another sustained rally in wave (v) of C and so far the upper channel remains valid.

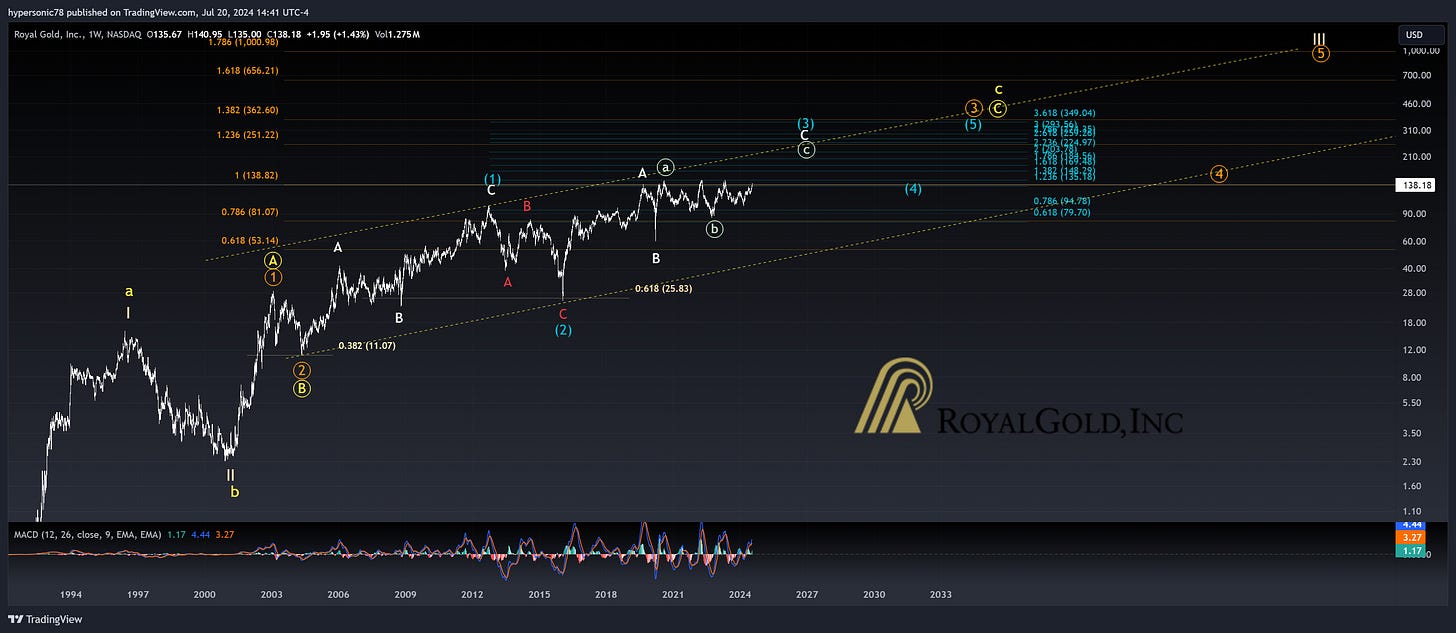

Royal Gold Inc (RGLD)

Royal Gold is a brand new chart for me as well that I needed to create from scratch for this Surf Report. Royal Gold is one of the world's leading precious metals streaming and royalty companies. Royal Gold began in 1981, as Royal Resources Corporation, an oil and gas exploration and production company. However after several good years, oil prices collapsed in 1986, leading the company to shift its focus from oil and gas to gold. The longer term chart is clearly in some sort of a larger degree uptrend that can count as a huge multi-decade 3 wave ABC or I-V Cycle. There are plenty of diagonals to be seen though within the lesser degree counts but the Fib extensions and retracements do align well with the current waves trending upward in a C wave within an Intermediate (3). Zooming into the 4-hr chart, we can see price may be entering the very heart of wave (iii) of Minute C but price will need to break through that Fib resistance above $150 to confirm.

Pan American Silver (PAAS)

PAAS is getting pretty popular in this series! PAAS is a top holding in all four ETFs we’re reviewing in Endless Summer; it’s the #1 holding in SILJ, #2 in SIL, #3 in GDXJ, and #12 in GDX. Let’s do an update for the 144-min near term chart. I only see a clear 3-wave rally so far so I would prefer to see one more wave up for a full 5 waves before considering wave 2 is over. Price had a nice reaction off the 50% retrace so let’s see what this next week or two brings. If the low in Minor wave 2 is confirmed we’ll need to consider higher wave extension targets for waves 3 and 5.

Alamos Gold Inc (AGI)

Like KGC, we also looked at a zoomed out view of AGI in Surf Report 9.4-1. Zooming into the 144-min chart shown below, AGI is filling out wave (iii) very well and appears on its way to completing micro 5 of Minuette (iii) within Minor degree 3. Wave 3s are where we want to be surfing and this particular gold miner is showing us how wave 3s typically behave which is up-and-to-the-right for a rising bullish wave. Steady as she goes!

Harmony Gold Mining (HMY)

HMY is also becoming a more frequent set of waves we visit in our Endless Summer Series. HMY was first reviewed in Surf Report 9.4-1 (GDXJ) in the larger degree view but then we zoomed in to the 144-min chart in Surf Report 9.5-1 (SILJ). In that report published a couple weeks ago, we were considering the potential that all of wave (iv) was complete and price was already on its way to higher levels in wave (v) of C. Since price extended a bit higher and was followed by a sharper correction, I am making a slight modification in Minuette wave (iii) as shown. I think we are now seeing the wave (iv) corrective pullback and the what we previously considered wave (iv) was really a wave Subminuette wave iv within wave (iii). This count fits much better within the larger structure in my view.

Endeavour Mining (EDV.TO)

We also reviewed EDV.TO in Surf Report 9.4-1. Zooming in once again inhe 144-min chart, we can see we got a nice rally off the June lows. Is wave 2 complete? Until we actually see price break through Fib resistance above, we'll need to consider that this rally is an extended b wave instead of the running flat correction shown for wave 2 and a potentially deeper wave C of 2 is ahead. Again this deeper correction would also form a really nice looking inverted head and shoulders and an excellent place to enter if wanting to hop on your board to ride a wave 3 for some pretty decent Elliott Wave surfing.

Zhaojin Mining Industry (1818.HK)

Our final chart and the 16th largest holding in the GDX is Zhaojin Mining Industry. Zhaojin is one of China’s largest gold producers and gold smelting companies. The company integrates exploration, mining, processing and smelting operations, and focuses on the development of the gold industry. Like AU and RGLD, Zhaojin is a new chart I had to develop from scratch for this report. After some consideration and double checking some Fibs, I think Zhaojin shares, which are traded on the Hong Kong stock exchange, are in a very long term Cycle III uptrend which may take many years to fill out. Price is now breaking above Primary degree Fib resistance which is always a great sign of waves continuing in an uptrend. The next time we cover Zhaojin, we’ll zoom in a bit closer.

Summary

These senior gold producers in GDX continue to look constructive. Although we are beginning to see some consolidation in the sector, many charts are presenting corrective waves which will rebuild energy for the next move higher. Let’s not get thrown off our boards if we get frustrated with the current surf. The tide is rolling in for gold and silver miners to continue playing catch-up to the metals in the next waves up. Before we end this Surf Report let’s read some more wise words from the legend Kelly Slater….

Your surfing can get better on every turn, on every wave you catch. Learn to read the ocean better. A big part of my success has been wave knowledge.

-Kelly Slater

My hope is that with every chart, every surf report, and every Elliott Wave you “catch” you are getting better and more confident in reading the price action for stocks you are watching or investing in. Learn to read the waves. Deeper Elliott Wave knowledge is something we each can strive for. Know when your counts invalidate and be sure to consider alternate counts with every wave so that you can be prepared to adjust if you need to.

I hope you enjoyed this Surf Report! The next report will revisit the SIL ETF and cover the next batch of holdings within that fund. Now normally I publish a report every couple weeks which is a cadence I can keep pace with. Since my family has a vacation planned at the end of this month, I will be publishing the next report a little early and plan to have it ready for your review next weekend! We’ll then return to our regular 2-week cadence thereafter.

Until next time…

Cheers and #EndTheFed!

-Hypersonic78

Disclaimer: None of this is financial advice! Please do your own diligence. The views expressed here and other Surf Reports are my own. Only risk what you can afford to lose in these crazy markets. Know your timeframes, parameters, and personal risk tolerance.

Position Disclosure: I remain long physical silver and gold (mostly silver) and am long a handful of individual precious metals mining shares not listed here.

Keep reading with a 7-day free trial

Subscribe to Hypersonic Elliott Wave Surfer to keep reading this post and get 7 days of free access to the full post archives.