Surf Report 9.3-1: The "Endless Summer" in Precious Metals and Miners

Silver Producers, SIL Part 1

As timeless as “The Endless Summer” was, my all time favorite surfing documentary was a film released in 2003 called “Step Into Liquid.” Interestingly enough, the film was written, directed, and edited by Dana Brown, the son of Bruce Brown, who made "The Endless Summer". Pretty cool that Dana followed in his father’s footsteps! This captivating piece of cinematographic work sought out and successfully placed viewers inside the waves, tubes, pipelines, and barrels of the surfer’s world of liquid blue and turquoise.

“All it takes is, you know, just one wave…not even that. One turn. You know just one moment that keeps pulling you back to have another moment. And it never ends.”

-Gerry Lopez (aka “Mr. Pipeline”)

Truly the power of riding the ocean’s waves is exhilarating to say the least. This is especially true when its a good wave and you understand what its doing. One good turn can lead to another. I believe the same is true with riding Elliott’s waves. We just need to find the best waves to ride to have our own “moments.” Because Elliott’s waves are fractal in nature and self similar in varying degrees of time, there are endless opportunities within the markets when one understands how the waves are behaving. And it never ends.

In this series we seek to understand what Elliott’s waves are doing within the precious metals and mining sector by reviewing the top holdings in the Global X Silver Miners ETF (SIL). Now is NOT the time to sit idly on the beach. The Surf is UP!

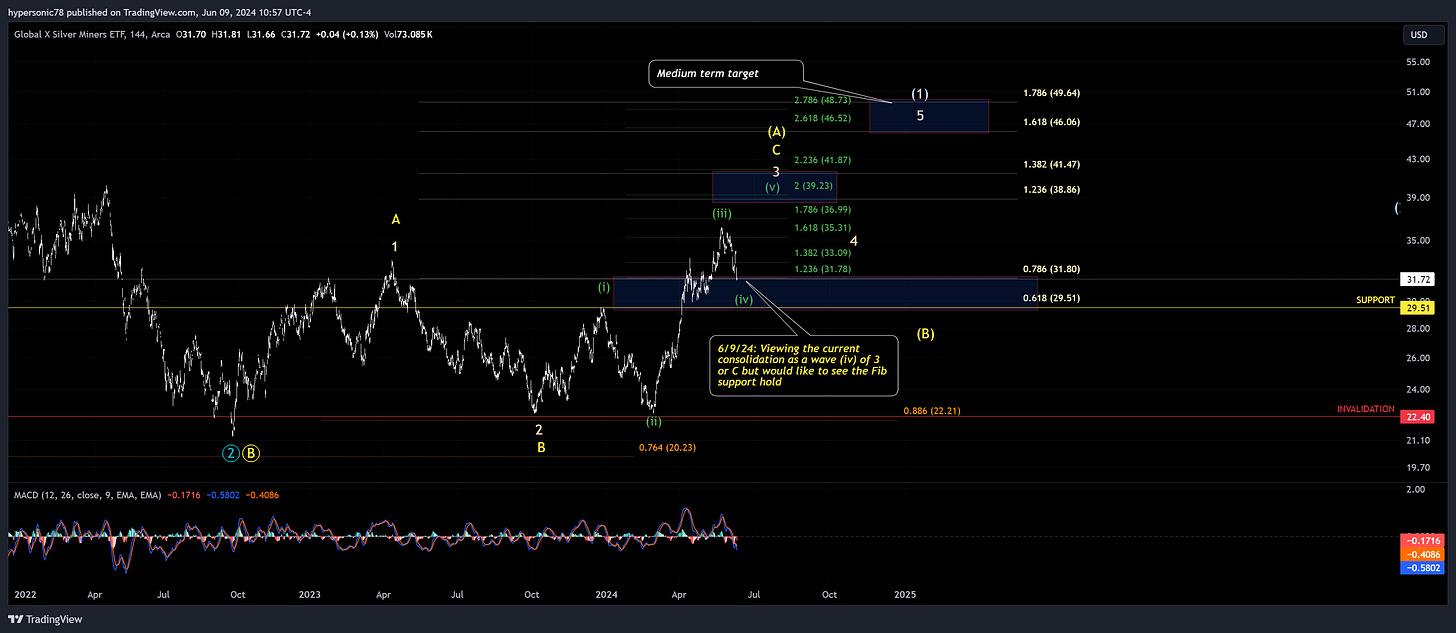

SIL Update

In Surf Report 9.1 we looked at the bigger picture in SIL with the 2-day chart which showed Intermediate and Primary degrees. This time we’ll zoom into the 144 minute chart to see what the waves are doing on the Minuette and Minor degree scales. Price appears to be making a 5 wave impulse in minor degree wave 3 of Intermediate (1). We want to see this complete with a full five waves before we can remove the alternate ABC diagonal count in yellow. Support remains near the $29.51 level.

Wheaton Precious Metals (WPM)

WPM is not only a top holding the GDX but also the largest holding in SIL. We looked at both the larger structure 5 day and 144 min charts in Surf Report 9.2-1. Nothing has changed in the large degree view so let’s focus on the near term 144 min chart for WPM in this report. WPM hit the 1.382 extension in late May in wave (iii) of Minor degree 3. Price is now consolidating in wave (iv) which would ideally remain above the December 2023 wave (i) high around $50.95 to remain impulsive.

Pan American Silver (PAAS)

We last looked at PAAS in Surf Report 2 where we reviewed the top holdings in the GDXJ. Nothing has really changed since then in the larger structure but with the lower low I do think this is behaving more as a larger degree diagonal and have updated my counts accordingly. Price has made 5 waves up from the February lows for Primary B. Wave 2 looks to have begun given the last weeks price action. This is a gentlemen’s entry for those that wish to get on the PAAS train before it leaves the station in a Wave 3

Buenaventura (BVN)

BVN was reviewed in Surf Report 3. Nothing has changed in the larger degree count. There was risk of lower Primary wave 2 but as you can see from the updated chart below, price finally broke through the 14 year downtrend that began in 2010 and is now breaking through major Intermediate degree Fib resistance which greatly reduces the risk for a lower low. Wave 3s are where some of the best Elliott Wave Surfing can be found and BVN appears to be entering the heart of an Intermediate (3) of a Primary 3!

Hecla Mining (HL)

We also reviewed America’s largest silver miner in Surf Report 2. I have slightly modified my count for Hecla in two ways. The first is that the Primary degree Wave 2 counts a bit better as a running flat that actually ended in May 2019. Then after closely looking at the Fibs and considering the longer consolidation from the June 2021 high, I believe we are now entering an Intermediate wave (3) instead of a 5 of (1) as previously shown in Surf Report 2. The overall structure remains bullish but it just means that HL isn’t as far along in Intermediate (3) of a Primary 3 as previously thought. Again once that multi-decade downtrend breaks coincident with major Fib resistance, HL will be on a historic bullish path, and riders of this wave will have their own Mr. Pipeline “moment”.

Coeur Mining (CDE)

CDE had a really nice rally from lows of Intermediate (2) in November 2023 and nothing major has changed in the larger degree counts which we first reviewed in Surf Report 3. Price is completing a Minor degree 1 within Intermediate (3) as shown in the 144 min zoomed in chart. Remember what we say about wave 3s! CDE will be entering the heart one after 2 completes.

Korea Zinc (010130.KS)

Korea Zinc was also reviewed in Surf Report 3. I’ve modified my longer term count just a tad though and have relabeled my degree counts. This structure fits much better as a larger degree Cycle which Cycle I completed in September 2015 and ended march 2020. It further has a Primary 1-2 in place, with Primary 2 holding the 61.8% Fib retracement level and could be at the very beginning of a Primary 3 which will take many years to complete if following the channel. Time will tell.

Triple Flag Precious Metals (TFPM)

One company and chart we didn’t cover in previous precious metals related Surf Reports is TFPM. TFPM is precious metals-focused, streaming and royalty company with a portfolio of streams and royalties that include the Northparkes copper-gold mine in Australia (CMOC), the Cerro Lindo polymetallic mine in Peru (Nexa), the Fosterville gold mine in Australia (Agnico Eagle), the Buriticá gold mine in Colombia (Zijin), the Impala Bafokeng Operations in South Africa (Impala Platinum Holdings Limited), and the Young-Davidson gold mine in Ontario (Alamos Gold), among others. TFPM IPO’d in May of 2021, price history is limited so any larger degree wave extension targets will need to wait. For now lets focus on the Minor degree. The wave structure thus far seems to fit best as and ABC diagonal in my view where price is now filling out an impulsive 5-wave C wave. We’ll need to watch closely after the 5 waves are fill out completely in C as that could be all of an Intermediate (1). Otherwise if price only pulls back moderately holding Fib support, we could see a larger wave 4 and 5 before Intermediate (1) finishes.

First Majestic Silver (AG)

AG was first reviewed in Part 10 of the U21CSD Series and then again in Surf Report 3. Here I’ve added a few alternate ABC diagonal counts we should be aware of when surfing the Elliott waves of this potential monster. If the Primary Wave 3 in yellow is in the works, then it should fill out at a 5 wave intermediate structure. This will also be true if it is now starting a Primary wave 3 shown in orange.

Price may have found a meaningful bottom in February 2024 but we only saw 3 waves up so we should now consider a diagonal is also in play in the smaller Minor degree for what be the Intermediate (1) structure. Positive divergence is building in the MACD as a (c) wave completes so a sharp reversal is likely ahead in my view. I’ve added some notes to the chart on what could happen thereafter.

Summary

I hope you enjoyed this Surf Report! Again these charts for silver miners are indicative of a larger uptrend taking shape in the sector with many in the early stages in a Primary degree wave 3. Some smaller degree consolidation waves are now underway which will give experienced Elliott wave surfers a chance to add more shares if they choose, or new riders to join in on the fun. The next report will begin reviewing the waves within the GDXJ ETF. As mentioned before, we’ll be taking a merry-go-round approach to this series reviewing holdings in the GDX followed by the SIL, followed by GDXJ, followed by SIL, and then back again to GDX.

I’ve begun adding some additional details for each chart covered in the current report as well as revisiting charts from the previous surf reports for premium subscribers. I deeply thank those who have subscribed already.

Until next time…

Cheers and #EndTheFed!

-Hypersonic78

Disclaimer: None of this is financial advice! Please do your own diligence. The views expressed here and other Surf Reports are my own. Only risk what you can afford to lose in these crazy markets. Know your timeframes, parameters, and personal risk tolerance.

Position Disclosure: I remain long physical silver and gold (mostly silver) and am long a handful of individual precious metals mining shares including AG and HL which were analyzed here.

Keep reading with a 7-day free trial

Subscribe to Hypersonic Elliott Wave Surfer to keep reading this post and get 7 days of free access to the full post archives.