Surf Report 9.4-3: The "Endless Summer" in Precious Metals and Miners

Junior Gold Miners, GDXJ Part 3

We’ve been covering a variety of topics related to surfing ocean waves and how we may apply those lessons to riding Elliott’s Waves. I’ve also introduced you to a number of legendary surfers along the way such as Laird Hamilton, Kelly Slater, Stephanie Gilmore, and Duke Kahanamoku. You may be wondering who is rated the best surfer at the present date. That title currently belongs to John John Florence who took the top spot in the 2024 World Surfing League Championship tour. John John is an American surfer from Honolulu, Hawaii and is considered one of the most dominant pipe surfers in the modern era. Let’s watch John John shoot through these pipes and appreciate his courage, balance, and skill which has lifted him to the top of the sport.

I know y’all wondered where he went when that wall of water encircled him in that first tube he caught! Am I right! What a ride!

John John is quoted saying the following…

There's a risk to everything you do. You can take off on a one-foot wave and get hurt; you can take off on a ten-foot wave and get hurt. You just don't think about it at all. You just go for it. When you kick out of a really big wave, it feels pretty damn good. You want to do it again.

Just as John John highlights, there are risks in everything. Risks themselves can never totally be eliminated in surfing as there always a chance you can get hurt. The same goes with surfing Elliott’s Waves as there is always a chance you can lose money on an investment. However, understanding the risk is important as well as mitigating the risk as much as possible by understanding the wave structures at play. Surfers mitigate risk by practicing and tuning their skills. Every wave they ride they get a little better. We continue to do the same here and practice our Elliott Wave techniques, exercise patience, and learn from our mistakes. I know you will catch that big wave you are looking for such as the heart of a wave 3 or a mania wave 5. I also know it will happen more frequently if you continue to work on it and begin to recognize opportunities when they become apparent to the Elliott Wave trained eye. I’ve caught a few big ones myself and indeed, it feels pretty damn good! There certainly seems to be some big waves continuing to form in precious metals and miners so let’s continue scouting them out with another Surf Report!

For this report we will continue our review of the VanEck Junior Gold Miners ETF (GDXJ). Last report we took a look at Silver so let’s turn our attention to Gold before moving on to individual miners within the GDXJ.

Gold Update

Gold is beast. So many mainstream financial media folks can’t seem to understand why it keeps going higher and higher with each passing week and month. Despite the DXY showing recent strength, gold still shows resilience when in the past such a move would have hammered the price of gold. We Elliott wave surfers know the reason. Gold is in a wave 3. Minor 3 of Intermediate (5) to be exact. As we see in the chart a shallow wave iv has potentially been completed with price on its way to wave v of (v) of 3 targeting $2750+. This is just wave 3 folks. We still have a parabolic wave 5 ahead which will likely take gold above $3100 (or probably higher) in the coming year or two. Only the most mismanaged gold producers will lose money in such an environment.

Iamgold Corp (IAG)

We recently did a larger degree analysis on IAG in Surf Report 9.2-3. IAG is also present in the GDXJ as a top 20 holding so now lets zoom into the smaller degrees and timeframe on the 144-min chart to see how Minor wave 3 of Intermediate (3) is progressing. I think we are seeing a nice (i)-(ii) start to wave 3 of (3) but we need to see a full 5 waves up, corrective 3 waves down in order to help confirm the October 9th low in (ii). Fib resistance overhead is set between $5.59-$5.91. A break out from those levels will signal that the heart of Minor 3 is underway and could also extend much high than I’ve shown.

Lundin Gold Inc (LUG.TO)

Lundin Gold is a Canadian mining company headquartered in Vancouver, British Columbia. The Company’s 100 percent owned Fruta del Norte gold mine, located in southeast Ecuador has been in production since late 2019. The Fruta del Norte gold mine is one of the highest-grade operating gold mines in the world with probable reserves of 4.92 million ounces at an average grade of 8.7 grams per tonne gold. Lets look a the chart. LUG.TO has been on a tear with price breaking through Intermediate Fib resistance in the heart of a powerful Intermediate wave (3) of Primary 5. This again is exactly the type of price action one would expect to see in the heart of a wave 3. We can even see price accelerating into the next price trend channel as well.

New Gold Inc (NGD)

We last reviewed the larger degree count for NGD in Surf Report 4.2 and then updated it in Surf Report 4.3 summary section. At that time we were looking for Intermediate wave (2) low struck in September 2022 to hold and confirm. Since that report NGD shares have rallied over 150% and have broken out from the decade long downtrend line. I’m now viewing NGD as completing Minor 3 within Intermediate (3).

OceanaGold Corp (OGC.TO)

Another new chart to this series and Substack is OceanaGold Corp which is gold mining and exploration company based in Vancouver, Canada and Brisbane, Australia. OGC.TO operates the Haile Gold Mine in the United States, the Didipio Mine in the Philippines, and the Macraes and Waihi mines in New Zealand. When we look at the 5-day chart, a massive 3-wave diagonal bull flag that appears to pop out with a steady horizontal price channel that has lasted more than a decade. Its anyone’s guess when the upper portion of the flag begins but it may be making an attempt here with price higher lows since March 2020. I’ve shown two possible ways the Primary C wave could complete with either an 3 wave diagonal in yellow or an 5-wave impulse in green in the Intermediate degree.

Centamin (CEY.L)

Centamin is a gold mining company focused on the Arabian-Nubian Shield with offices in London, UK; Mount Pleasant, Western Australia; and Alexandria, Egypt. The company’s principal asset, the Sukari Gold Mine, is a long-life, bulk tonnage open pit and underground operation producing 450k ounces in 2023 and guiding above 470k ounces in 2024. Since CEY.L is a brand new chart to the Substack lets begin with the larger degree view. Here we see five Intermediate waves up from 2004-2010 to complete its first Cycle high followed violent 2-year correction where price collapsed 90%. After price bottomed in December 2012, a nice rebound occurred setting off a decade long Primary 1 of what will be a multidecade Cycle III. I now am counting Intermediate (5) of Primary 1 underway and still has some work to do to completely fill out.

Coeur Mining (CDE)

Since we last reviewed CDE in Surf Report 9.2-3 some significant news has happened. On October 4, it was announced that Coeur Mining would acquire all of the issued and outstanding shares of SilverCrest in a deal worth $1.7B. Last Surf Report is was First Majestic buying Gatos Silver and now we have CDE acquiring SILV. As a shareholder in SILV I will receive 1.6022 shares of CDE for every share of SILV I own. Its good thing I’ve been tracking the CDE Elliott Wave count and will be watching it closely to help me decide whether or not I want to hold onto my CDE shares or not. Lets review the 144-min chart. As we can see, Minuette degree wave (v) is still in progress with price attempting to overcome a downward trendline resistance that has been in place since 1996! I’m definitely considering holding onto those CDE shares if we can complete that full five up in Minor degree 1!

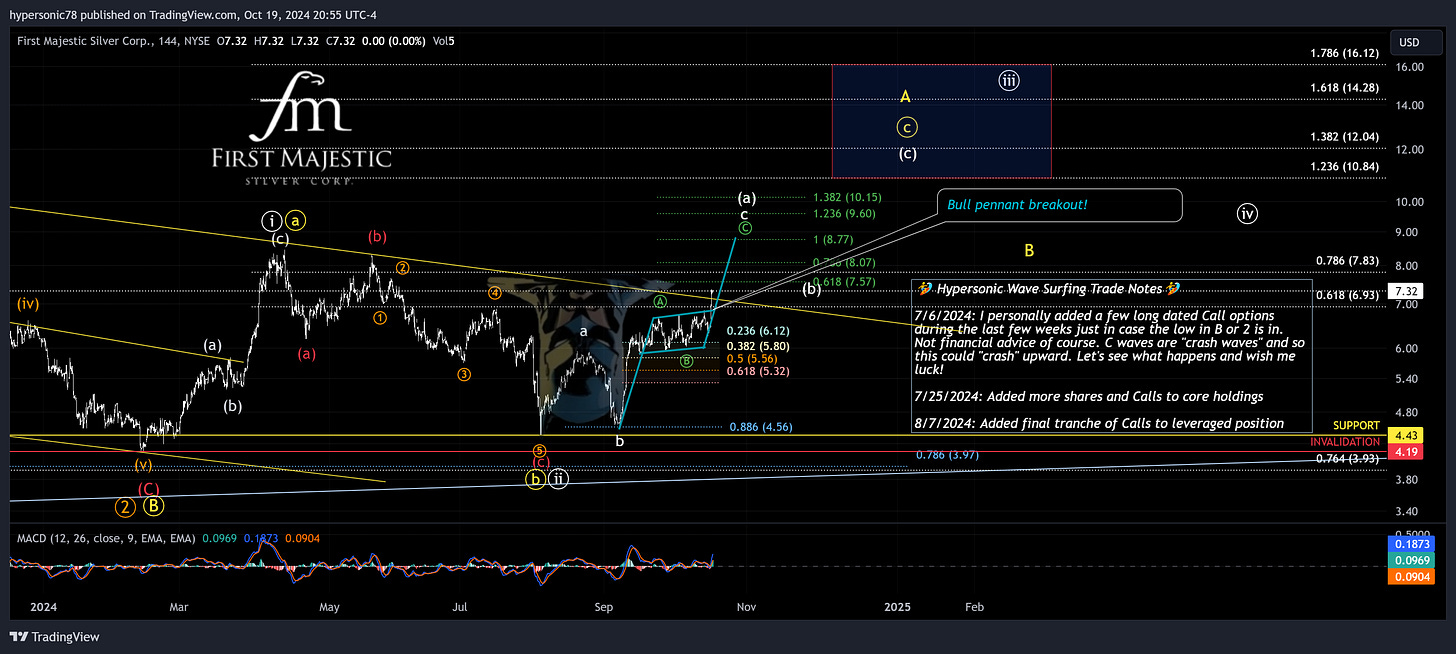

First Majestic Silver (AG)

Since Surf Report 9.5-2, AG made yet another deep retrace but held a slightly higher low in a Subminuette b wave within a Minuette (a) wave in what I jokingly referred to on my X account as the classic “upside down Dark Knight” pattern. AG sure has been a “Joker” for quite a while and continues to test investors patience. Remember AG is a top 20 holding in SIL, SILJ, and now we see its also a holding in GDXJ so when investors buy any of these ETFs, they are adding support for AG shares by extension. All jokes aside, that bull pennant stands out and the structure is in need of a full c wave to complete Minuette (a) of Minute c of Minor A. I’m still holding my longer dated calls on AG which are now in a firm profit after Friday’s price action. I might have to call Alfred up and have him advise Batman to strap a surfboard on top of his Batmobile so he can be ready to catch these c waves. And in case you were wondering, Batman does indeed surf!!

Artemis Gold Inc (ARTG.V)

We took a look at the larger degree count with a 2-day chart for ARTG.V in Surf Report 9.5-2 so now lets zoom into the 144-min to see how Minor wave 5 of Intermediate (1) is progressing. Minuette (iii) continues to press higher and has already reached the 1.618 Fibonacci extension. Howe but we can also see negative divergence begin to build on the MACD. I think a wave (iv) is right around the corner. Slow and steady wins the race with ARTG.V with a very smooth wave (iii) of 5!

Summary

Gold and many of these gold miners keep marching higher. With gold likely starting another wave up in it Minor wave 3 of Intermediate wave (5), many miners still have have some catching up to do, and some miners have a lot of catching up to do. We’ve now covered 24 of 86 holdings in the GDXJ. I would like to note that since Surf Report 9.4-2, Kinross Gold Corp (KGC) has been removed from the ETF and replaced with larger weightings in Evolution Mining and B2Gold. We are making good progress regardless and have now covered over 60% of the weighted holding in GDXJ. With KGC removed, PAAS, AGI, EVN.AX, and BTO.TO represent over 30% of GDXJ’s weighted holdings so we’ll have to keep an eye on those charts as they progress.

Thank you for reading this Surf Report! We’ll be back with another report in a couple weeks with the next batch of holdings in SILJ. Silver itself has quite a bit of catching up to do with gold so it goes without saying silver miners do as well!

But before we close this report, I would like to quote John John one more time as I believe we can take some wisdom from it…

Success is not about winning every contest or achieving every goal, but rather about the journey and the lessons learned along the way.

-John John Florence

John John is a smart dude. Your success in Elliott Wave is not about nailing every single count or winning every trade you make, but rather about what lessons you learn along the way to make yourself a better trader, and investor, and Elliott Wave Surfer!

Until next time…

Cheers and #EndTheFed!

-Hypersonic78

Disclaimer: None of this is financial advice! Please do your own diligence. The views expressed here and other Surf Reports are my own. Only risk what you can afford to lose in these crazy markets. Know your timeframes, parameters, and personal risk tolerance.

Position Disclosure: I remain long physical silver and gold (mostly silver) and am long a handful of individual precious metals mining shares including AG which was reviewed in this report.

Premium Content:

Keep reading with a 7-day free trial

Subscribe to Hypersonic Elliott Wave Surfer to keep reading this post and get 7 days of free access to the full post archives.