Surf Report 9.2-3: The "Endless Summer" in Precious Metals and Miners

Senior Gold Producers, GDX Part 3

So here we are just sitting on our boards looking out over the water. Its early in the morning and the sun has just risen over the horizon as its soft rays glisten over the crisp, cool water.

We just paddled out for our dawn patrol surf to beat the winds and crowds before they begin adding turbulence and traffic to our precious waves. The sets have been rolling in at regular intervals two or three at a time with intermittent pauses.

Its almost time.

Another set is coming in soon. Will this be our first wave of the day? I have a certain Clash song in my head which happens to fit this scene and moment perfectly…

Decisions, decisions…

Stop. Before we do anything we need to take note of a couple things.

Aside from the timing of the waves we must understand how they might break. Waves can break to the right or left. They can form an “a-frame” or be totally closed out. A good surfer must be able to identify what type of waves are breaking quickly. The faster we can identify the wave and its peak, the faster they we can react, respond, and position ourselves.

Now we’re ready. We noted the wave timing. There’s the peak; its going to break to right…Let’s go! Paddle! Paddle! Paddle!! Go Go Go!! Get on it!! 🤙

In Elliott Wave it is also important to understand how the waves are going to “break”. Will the price breakout into a bullish move higher or stall out and drop to another low? How can we tell? It’s not always easy but just like the ocean there are clues that are given. One of the key things to look for is how a wave begins its move at a smaller degree. For example suppose we have patiently been waiting through a period of price consolidation with all waves of a standard ABC structure completed. If we see a 5-wave impulsive reversal followed by a small corrective looking (overlapping erratic type waves), that could be the first hint that the next wave higher has begun. However, what if the impulsive 5 wave structure was followed by another impulsive 5-wave downward move that broke Fibonacci support levels?? Well then we may be dealing with a different structure and we will need to adjust accordingly.

As we return to our Endless Summer in Precious Metals and Miners, we need to take note of how the waves are breaking. Silver and GDX are at important decision points in their structures. Although we could possibly see another local low in each chart there is also a chance for a violent move upward. Let’s see what we can see. For this report we will also continue to review Senior Gold Producers within the VanEck Gold Miners Equity ETF (GDX). We’ve already covered many of the charts in this next group of GDX holdings within other Surf Reports for SIL, GDXJ, and SILJ. Once again we’ll update near term charts for holdings that are repeated which will be the majority of this report. I have only one new chart to show you which has not been covered in any previous report.

GDX update

Lets first zoom in for an update to GDX. Now I normally update this chart every Surf Report for premium subscribers but will share this update here for all to see given its been a while since it was reviewed in Surf Report 9.5-1. A lot has happened since that report published in early July and I’m now counting GDX as making a running flat bottom in Minuette (ii) in early August. The biggest question I have now is whether GDX is set to immediately breakout into the heart of its wave (iii) or if there will be perhaps one more pullback. As you can see in the micro count insert within the 144-min chart below, we have 5-waves up from the early September low in wave ii. There are now 3 potential paths these waves can “break”. My primary count is the green micro count with a corrective pullback completing in coming week. But there is also a chance it could just take off directly from here as shown in the blue count. However any impulsive breakdown below Fib support would signal that a lower wave ii (yellow alternative count) is in store before the melt-up begins. An exciting week lays ahead for GDX and Senior gold miners.

Evolution Mining (EVN.AX)

We last looked at EVN.AX in Surf Report 9.4-1 where we updated the larger degree count so now we’ll zoom into the 144-min chart count to see what may be happening. Price is now making an attempt at breaking through Minor degree Fib resistance in the heart of Minor degree 3 uptrend. I don’t see any signs of negative divergence forming so this has room to run. You’ll notice I do have an alternate ABC diagonal wave count potential on the chart, but we’ll have to see what kind of pullback we get after a 5-wave structure completes in the Minuette degree.

B2gold Corp (BTO.TO)

In Surf Report 9.4-2, I gave larger degree view for B2gold where I was expecting a slightly lower low in (B). I even stated “Friday’s price action makes me think this is the highest probability at this time.” That was Friday August 9. Since then probabilities have shifted quite a bit that the Intermediate low is in given the impulsive 40%+ rally off that day’s low. This would imply we saw a truncated bottom in wave (v), Minute C, Minor Y, Intermediate (B). Price also rose higher that the previous wave (iv) and there is no evidence of negative divergence which would indicate another deep selloff is at hand. I would still like to see a fuller 5-up here to complete a Minor degree 1 as more confirmation but as I said before, the probability that a new upward trend is in place has increased given the above considerations.

Hecla Mining (HL)

HL has made some very good progress since Surf Report 9.4-2, where we were looking for a confirmed low in Minuette (ii). It has since made 5 waves up with a corrective pullback and now I can also count a micro 5-up from the wave ii low struck earlier this month. Price is now challenging Fib resistance and has all the ingredients needed for a price breakout through Fib resistance. That multi-decade downtrend line is in Hecla’s sights! Also take note that HL is a holding in every Precious Metal ETF we are covering in this series.

Eldorado Gold Corp (EGO)

In Surf Report 9.4-2 we also reviewed the larger degree structure in EGO so in this report we shall zoom into the 144-min timeframe. Here we see Minor degree 3 marching on with price breaking through Minor degree Fib resistance. I still think we can see a little more extension in Minuette (iii) but I will note that the structure within (iii) is getting fuller and there is some negative divergence being seen on the MACD so I would not be surprised if we soon see a pullback in what will be wave (iv) of 3.

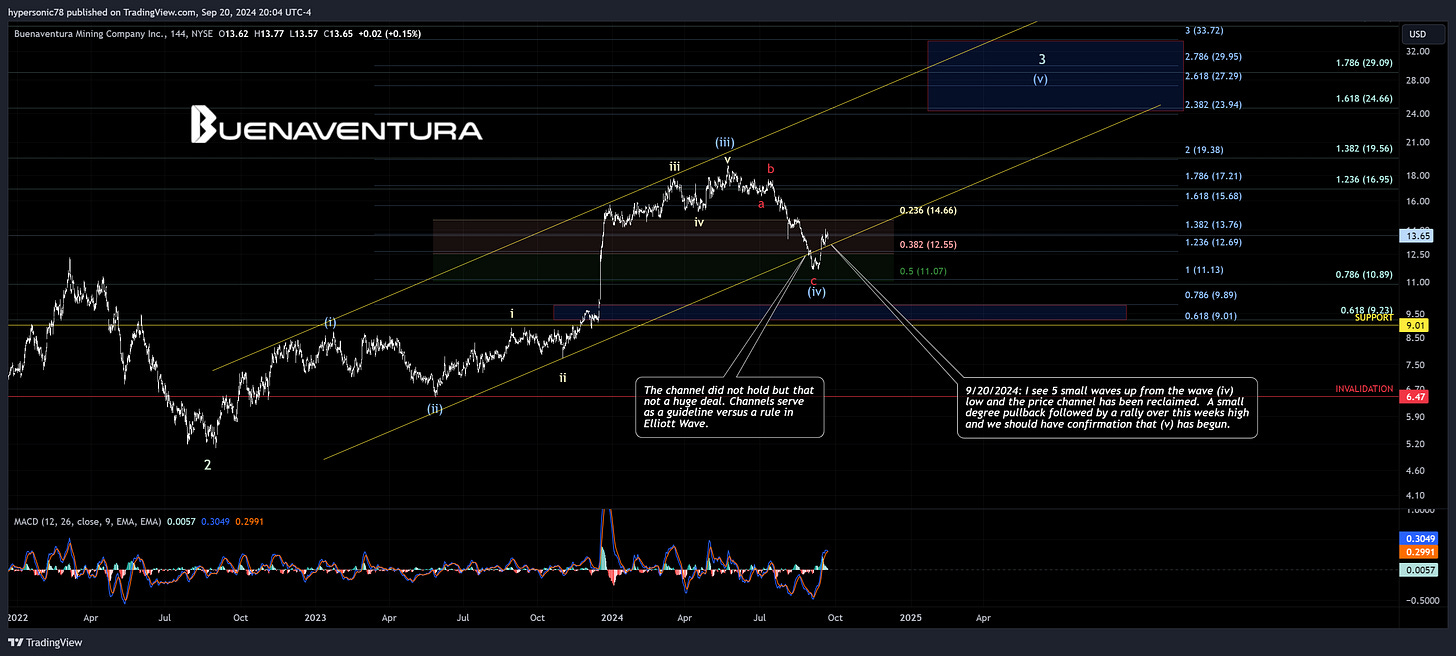

Buenaventura (BVN)

Like HL, BVN is popular and is a top holding in SIL (Surf Report 9.3-1), GDXJ (Surf Report 9.4-1), SILJ (Surf Report 9.5-1), and GDX as well. Since 9.5-1, price continued to decline within wave (iv) and had a deeper retracement than I expected. It had what I believe is a false breakdown from the channel finding support just below the 38.2% Fib level. It then appeared to have a micro 5 wave rally from the low achieved in wave (iv) which is an initial indication that wave (v) of 3 has begun. We now want to see a small corrective pullback followed by a rally over this week’s high to confirm the local low is in place.

Osisko Gold Royalties (OR)

We also looked at the larger degree count in the 8-hr timeframe for OR in Surf Report 9.4-2 . Zooming into the 144-min chart to identify smaller degrees, we can see that OR is marching towards its Minuette wave (iii) of Minor degree wave 3 target and is making another attempt at breaking through Minor degree Fib resistance. I think its possible that wave 3 is filling out as an ending diagonal. Remember wave 3s are typically the longest waves and OR appears to be in the heart of an Intermediate wave (3).

Coeur Mining (CDE)

CDE has been covered in Surf Report 9.3-1 (SIL), Surf Report 9.5-1 (SILJ), and now GDX in this report. We’ll find out in a few weeks when we review our next set of holding for Surf Report 9.4-3 that its also a holding in GDXJ as well! Let’s see what has happened in the 144-min chart. Minuette wave (v) of Minor 1 now seems to be in progress with price attempting to overcome a downward trendline resistance that has been in place since 1996! The previous negative divergence has also been negated. Let’s see how high wave 1 will take us, as well as how deep or shallow the wave 2 will be thereafter. The higher wave 1 is and the shallower wave 2 is, the higher wave target extensions can be for the rest of the structure. CDE is one to keep an eye on!

Iamgold Corp (IAG)

IAMGOLD is an intermediate gold producer and developer based in Canada with operating mines in North America and West Africa. The Company has commenced production at the large-scale, long life Côté Gold Mine in Canada in partnership with Sumitomo Metals & Mining of Japan. IAG has steadily increased gold production and so far has produced 317k ounces of gold this year versus 212k ounces total in 2023. Since this will be a new chart in this series, let’s zoom out to the big picture / larger degree count. IAG was in a decade long decline which appears to have finally bottom in September 2022. IAG then had a 5-wave impulsive rally in the Intermediate degree and is fulfilling a very bullish inverted head and shoulders pattern. I think we now may be seeing the heart of Intermediate (3) as price is now challenging a breakout from Intermediate Fibonacci resistance.

Summary

These senior gold producers in GDX continue to look very constructive. A few we’ve reviewed today are also filling out wave 3s. That’s why its important to remember the larger degree trends that are in place when we see consolidations that are local within the larger degree wave structures. These are still very rideable waves and I hope you are learning how to catch them and stay on your boards instead of getting thrown off. We can certainly see another retracement in GDX itself but that would also be a smaller degree and buyable dip in my view. Remember that GDX is heavily weighted with NEM being the largest holding at 15%. In fact the top 5 holdings (NEM, AEM, GOLD, WPM, and FNV) represent more than 46% of the total weighted holdings of GDX. Premium subscribers will see these in more detail just as they receive more frequent updates on metals themselves and ETF tickers. I greatly thank those who have upgraded and support my work.

As I’ve mentioned before, my hope is every surf report you are learning something new and becoming more confident in reading the wave structures so you can catch them with your investment decisions (or choose to avoid certain waves altogether). We must always answer the question “Should I Stay or Should I Go” when deciding whether to invest our hard earned cash and savings in volatile non-linear markets.

I hope you enjoyed this Surf Report! In Surf Report 9.3-3 will again revisit the SIL ETF and cover the next batch of holdings within that fund. We still aren’t done with our Endless Summer by any extent and have quite a bit of work to do.

Until next time…

Cheers and #EndTheFed!

-Hypersonic78

Disclaimer: None of this is financial advice! Please do your own diligence. The views expressed here and other Surf Reports are my own. Only risk what you can afford to lose in these crazy markets. Know your timeframes, parameters, and personal risk tolerance.

Position Disclosure: I remain long physical silver and gold (mostly silver) and am long HL which was reviewed in this report as well as a handful of other individual precious metals mining shares not listed here.

Keep reading with a 7-day free trial

Subscribe to Hypersonic Elliott Wave Surfer to keep reading this post and get 7 days of free access to the full post archives.