Surf Report 9.5-3: The "Endless Summer" in Precious Metals and Miners

Junior Silver Miners, SILJ Part 3

In Surf Report 10.1, we reviewed the basic mechanics of how waves form and how their energy is released. But where do waves come from? They just don’t show up out of nowhere, agreed? Like anything in life they are a result and reaction to something else with one or more catalysts to begin their creation. A catalyst is anything that precipitates an event. The most common catalyst for ocean surface waves is wind blowing along the surface of the water. The wind creates a disturbance that steadily builds as air continues to blow and the wave crest rises. Adverse weather or natural events can produce larger and potentially hazardous waves to life and property. Severe storm systems moving inland often create surges. These long waves are caused by high winds and a continued low pressure area. Undersea earthquakes or landslides occurring at the ocean floor can act as huge catalysts displacing large amounts of water very quickly into really big waves. Anyone remember that scene in Escape From L.A. when Snake rides that tsunami in? Well, in case you forgot...

I love that scene!!

In the financial markets, catalysts are everywhere. Every quarter, companies report their earnings which can potentially move their share prices one way or another. Or how about that gold exploration company which just had some assays reported after and an expansive drill program? Did they hit the motherlode? I’ve found that its best to remain focused on the charts and let catalysts be catalysts. Would you believe me if I told you the Elliott waves would have formed anyways if that was their ultimate count? Catalysts can jumpstart the waves and affect near term price action but they are actually aren’t as critical as most believe when it comes to larger price movements in financial assets. I would like to share some observations from an important study I think you’ll find interesting. Here I will highlight some important insights by Mr. Avi Gilburt which he initially examined in a series of articles published in 2018. I encourage you to read his full article but will summarize a few items here…

In a 1988 study conducted by Cutler, Poterba, and Summers entitled “What Moves Stock Prices,” they reviewed stock market price action after major economic or other type of news (including major political events) in order to develop a model through which one would be able to predict market moves retrospectively. They were not even at the point of developing a prospective prediction model yet in their study. However, they found some very interesting conclusions which are listed here:

“macroeconomic news . . . explains only about one fifth of the movements in stock market prices.”

“many of the largest market movements in recent years have occurred on days when there were no major news events.”

“there is surprisingly small effect [from] big news [of] political developments . . . and international events.”

“The relatively small market responses to such news, along with evidence that large market moves often occur on days without any identifiable major news releases casts doubt on the view that stock price movements are fully explicable by news…”

In 2008, they conducted another study over a two year period. In this study they reviewed more than 90,000 news items related to hundreds of stocks. They concluded that large price movements in the stocks were NOT linked to any news items and said “Most such jumps weren’t directly associated with any news at all, and most news items didn’t cause any jumps.”

Isn’t that interesting? Going back to the surfing scene in Escape From L.A., notice that Snake didn’t wait for the catalyst to get up on that wave; He just positioned himself on his board and let the wave come to him. Nobody can predict news or events or how markets will react to them. However, these studies show that much of it is noise and we are better off focusing on the underlying wave structure to identify larger price trends and areas of price support and resistance before we position ourselves on our Elliott Wave surf boards.

That said there are many catalysts occurring in the precious metals and mining sector. The gold price continues its march higher with each passing month allowing well managed companies to increase their profit margins. We find ourselves in the midst of Q3 earnings season with many companies reporting their earnings to investors. Certainly some of these reports will serve as near term catalysts right? Maybe or maybe not. Let’s focus on some wave structures in junior silver miners once again and continue our analysis with another update of the Amplify Junior Silver Miners ETF (SILJ) and its top holdings. For this report, I have just one new holding to review in terms of its larger degree count. The remaining charts will include more near term updates from charts we’ve already reviewed in our Endless Summer Series as most all are also holdings in the SIL ETF.

SILJ Update

First let’s take another look at SILJ on the 144-min chart. In Surf Report 9.5-2 we were looking for that nice 1-2, (i)-(ii) setup. As seen in the chart below, price hit Fib resistance after a 5 wave up move and is now consolidating in a wave (ii) as expected. Silver miners took a hit this last week as metals pulled back but that was expected if your were following the wave structures that were forming. I said it in Surf Report 9.5-2 and I will say it again here. You don’t want to miss the next wave higher in junior silver miners!

Endeavour Silver Corp (EXK)

We did a larger degree update in Surf Report 9.3-2 published in July for EXK when I was questioning whether all of Minor degree wave 2 complete. It turned out that wave 2 was not complete and the rally that unfolded was an overextended (b) wave within a deeper wave 2 bottoming on August 12. EXK is now in the process of completing 5 waves up from that low and is pulling back in what at I’m counting as a wave iv of (i). Now wave 4s typically only retrace to the 38.2% from the price movement achieved from the bottom of wave 2 to the top of wave 3 which is around the $4.29 level. If price falls much further than that then we may need to consider all of wave (i) was achieved in late October but for now I’m assuming we have just a bit more to go in wave (i).

Silvercorp Metals (SVM)

In Surf Report 9.3-3 we observed in the larger degree chart of SVM that price was making an attempt to breakout into a wave 3 of an Intermediate wave (1) within Primary 3 or C. Zooming into a smaller timeframe 144-min chart we can see that Minuette degree wave (iii) continues to fill out but price retreated after it hit its head on Minor degree Fib resistance. Price is now consolidating in a wave iv of (iii) of Minor degree 3.

Hochschild Mining (HOC.L)

We also did a larger degree update for HOC in Surf Report 9.3-3 as price looked ready to challenge the longer term downtrend line which began in 2011. Zooming into the 144-min chart we can see that down trendline served as resistance for the (a) wave of Minor 5. Price is now pulling back in a potential (b) wave within the 3-wave diagonal for Minor 5 of (1) or (A). I initially thought (A) may possibly top out near the downtrend line resistance but given the strength of wave (a) we could see it go bit higher once (b) is done and price finally breaks out of 14 year downtrend.

i-80 Gold Corp (IAUX)

Our one new chart is that i-80 Gold Corp (IAUX) which is an exploration, development and production company whose goal is to achieve mid-tier producer status through the development of its four advanced-stage projects in Nevada. Hey did you know that Nevada is known as the “Silver State”? The Company has plans to process gold mineralization primarily at its central Lone Tree processing facility. As far as the chart is concerned, IAUX has been in a multi-year downtrend with a 5-wave channel holding firm since December 2022. I am viewing the entire structure as an Intermediate ABC correction that should reverse provided there is a five wave rally that completes with price breaking from from the downtrend. So far I’m only seeing 3 waves up so there is a bit more work to do before we can be certain the major low is in.

Vizsla Silver Corp (VZLA.V)

Our third chart that we are revisiting from Surf Report 9.3-3 is VZLA which is working its way up a 3 wave diagonal in Intermediate Wave (5). Let’s zoom into the 4-hour timeframe to look a little closer at what’s taking shape in the smaller degrees. The rally seen from mid August lows could be an extended b wave within a larger wave ii given its overlapping nature but that is not my primary count. One more wave higher and we will have a full 5 waves off the wave ii low adding confirmation that the heart of wave iii in VZLA is underway.

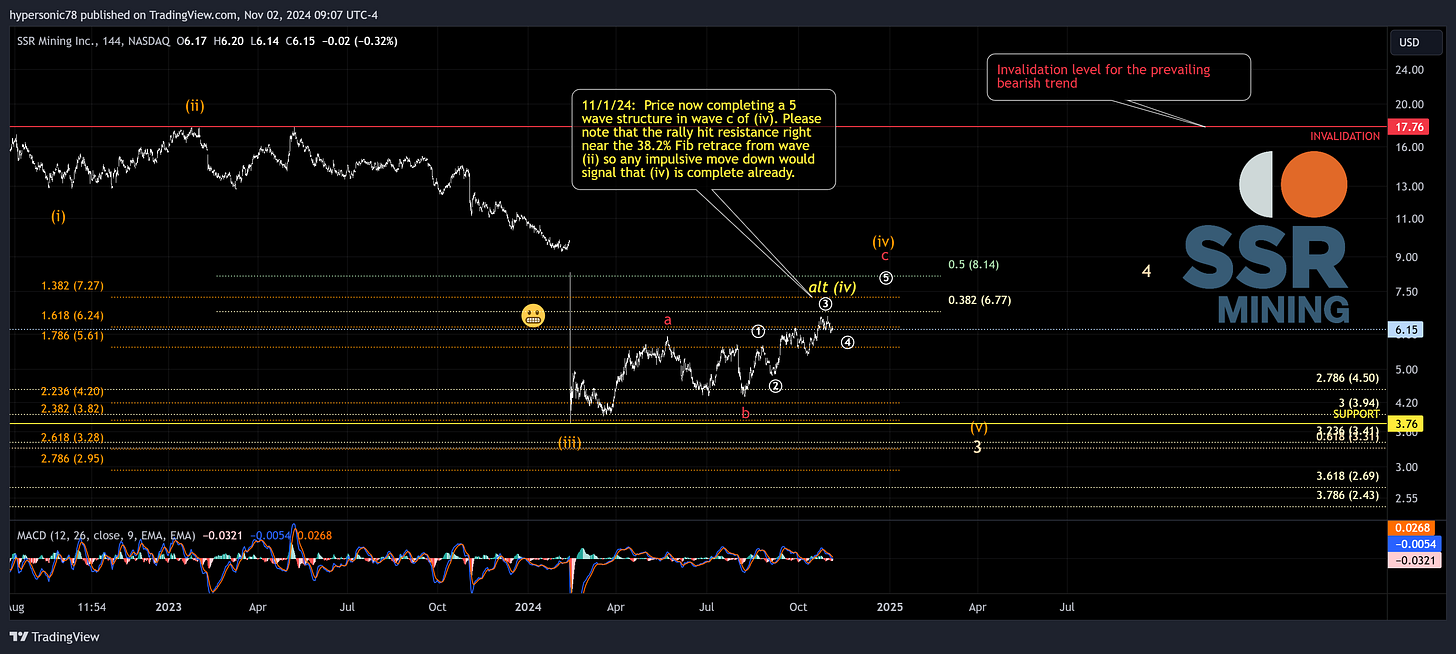

SSR Mining Inc (SSRM)

Along with EXK, we also took a look at the larger degree wave structure in SSRM in Surf Report 9.3-2. There we saw that SSRM is in a major downtrend until proven otherwise. We can’t help but notice the overlapping corrective structure filling in since the wave (iii) low in February and by my count is now in a wave (iv) of 3 down. I think we could see one more wave up in micro 5 of c of (iv) but its worth noting that the rally hit resistance right near the 38.2% Fib retrace from wave (ii) so any impulsive move down would signal that (iv) is complete already.

Eldorado Gold Corp (EGO)

We would need to return to Surf Report 9.4-2 (GDXJ holdings) to see the larger degree count in EGO. Then we did an update in the smaller degree count in Surf Report 9.2-3 (GDX holdings.) Yes EGO is considered a junior silver miner as a top 25 holding in SILJ.🤷♂️ Because I was curious, I looked at EGO’s investor presentation and the company does have sizable silver resources, but only at only 2 out of 6 of their projects at Olympias and Permana Hill. Additionally, the firm has a market cap of over $3B. That said I am not sure why EGO is showing up in a “junior” silver mining ETF (or GDXJ for that matter). We’d have to ask the fund managers that question. I just look at waves! We can see in a another smaller degree update below that price broke out of Minor degree Fib resistance this year which is very constructive. Evidence is growing that wave (iii) of 3 is now complete as price topped right at the 1.382 Fib extension. This needs a proper wave (iv) now and we could expect a retest of breakout near the $14 handle.

Fresnillo (FRES.L)

Our final chart for this report is also one we’ve visited before in Surf Report 9.3-2 where we looked at the larger degree setup in FRES. Price is now filling out a very nice impulsive 5 wave rally in (c) as expected and is now pulling back in a wave iv which should find support near £708. This rally isn’t quite over in FRES and I believe based on this Fib structure we can see one more push higher to complete Minute wave a (circle ‘a’ in orange) which also happens to sit right 8 year long downtrend line that is shown in the larger degree count in Surf Report 9.3-2. Please be prepared for a corrective b wave thereafter.

Summary

We’ve now completed our third go around of the top holdings of GDX, SIL, GDXJ, and SILJ and we are still not even close to being done with this series. And that’s a good thing because I believe, based on the wave structures we are seeing, that the rally in precious metals and miners has yet to run its full course. This last week we saw some consolidation in many of the miners were are following in this series. Was it the companies’ earnings releases along with more consolidation in the prices of silver and gold that caused these corrections to begin? Many will say that was the case but I will say that these catalysts simply allowed the corrective smaller degree wave 2s and 4s to happen as we would expect anyway. I’m personally not selling any of my longer term holdings in the sector but only trimming outperformers in the rallies and adding to others I like more on the dips. Before we return to look at the next set of holdings in GDX in Surf Report 9.5-4, we will return in a couple weeks to the Uranium sector and publish a new report in the Nuking Energized Waves series. There we will begin revisiting many of the top holdings in the URA ETF among others. I hope you enjoyed this Surf Report and found it informative.

Finally, if you are a US citizen please don’t forget to exercise your right to vote!

Until next time…

Cheers and #EndTheFed!

-Hypersonic78

Disclaimer: None of this is financial advice! Please do your own diligence. The views expressed here and other Surf Reports are my own. Only risk what you can afford to lose in these crazy markets. Know your timeframes, parameters, and personal risk tolerance.

Position Disclosure: I remain long physical silver and gold (mostly silver) and am also long a handful of individual precious metals mining shares including EXK and SVM which were reviewed in this report.

Premium Content below:

Premium subscribers make this publication possible. It takes lots of my time to track all these charts and create these reports. I don’t wish to make this a primary focus given other responsibilities I currently have but my time is valuable.

What’s included you may ask?

-Updates for Gold, Silver, GDX are covered in every Endless Summer Series Report

-Updates for other charts which have not been updated for a couple months. This particular report will include HMY, SA, MAG, ARTG.V, AYA.TO, GATO, SKE.TO, SILV, TGB, and FSM. It varies by report based on what ETF we’re reviewing.

-Access to the downloadable Surf Report spreadsheet with price data and linked charts

-Access to premium subscriber chat where you can ask me questions, see chart updates, make new chart requests, or talk about what Elliott Waves you are surfing.

Keep reading with a 7-day free trial

Subscribe to Hypersonic Elliott Wave Surfer to keep reading this post and get 7 days of free access to the full post archives.