Surf Report 9.4-1: The "Endless Summer" in Precious Metals and Miners

Junior Gold Miners, GDXJ Part 1

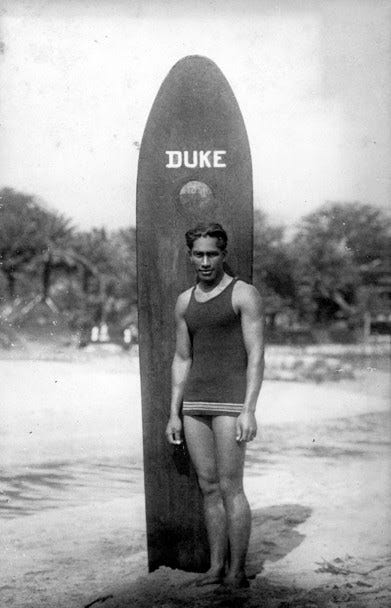

Catching a good wave when you are surfing is a big adrenaline rush. You can feel the energy of the wave pushing against your board, propelling you forward through the water. Its a great feeling. You have harnessed a small part of mother nature and become one with her. It can get addictive. It is addictive. But don’t get greedy. Wait for the right wave. As the grandfather of surfing, Duke Kahanamoku wisely said, “Just take your time - wave comes. Let the other guys go, catch another one.”

I believe we can apply the same principle to Elliott’s waves. If we aren’t sure of the wave counts or if they invalidate, its probably best to “let the other guys go.” There will always be other potentially better waves to catch. And so here we are seeking to catch the best waves in the Precious Metals and Mining complex. Let’s take our time and really try to understand what these waves are doing.

Before we paddle out, did you know that in 1929, Duke rode a monster wave for more than a mile at Waikīkī which was probably longest ride in modern times? A mile long wave!! What a ride! Let’s see if we can catch our own “monster waves” and continue our review and look at the top holdings in the VanEck Junior Gold Miners ETF (GDXJ). Let the surf reporting begin!

GDXJ Update

Since we revisited the longer term structure in GDXJ a month ago in Surf Report 9.1, let’s take a few moments in this review the smaller degree count in the 144 minute chart. As noted in the chart, we would like to see the impulsive structure within Minor degree wave 3 remain with wave (iv) holding the 38.2% Fib support. Going deeper than that would turn it into a less reliable diagonal. The MACD is curling up so there is potential for wave (v) of 3 to begin but we’ll need to be patient.

Kinross Gold (KGC)

Kinross Gold replaced Yamaha Gold as the largest weighting in GDXJ after Yamaha was acquired by Agnico Eagle Mines. KGC has also moved up nicely from the September 2022 lows which I’m now counting as either a Primary 2 or B low. Its still to be determined whether the much larger A-E triangle will fill out but as you can see in the 144 min chart the rally so far is filling out as an ABC diagonal for what would either be an Intermediate (1) or part of the Primary D structure. Looks like we could know the answer in a little as a year or so if the bullish Primary 3 or C waves take it much higher.

Pan American Silver (PAAS)

Since PAAS is the second largest holding in both GDXJ and SIL (which we re-reviewed in the previous Surf Report, we’ll do a quick update on the 144-min chart shown below to see how its progressing near term. I am doing updates for all charts that are covered in series so far on the 144-min / near-term views for premium subscribers so this will give you a flavor of what’s done there in case you are so interested in more timely updates. Here we see PAAS continuing to consolidate in a wave 2 after a nice 5-wave impulsive minor degree 1. However given the positive divergence building, wave 2 may already be done if we see an impulsive 5 waves up complete.

Alamos Gold (AGI)

AGI also held the Intermediate wave (2) lows of October 2022, broke out of the longer term downtrend, and now even has a Minor degree 1-2 and Minuette (i)-(ii) structure in place with price moving higher in the very heart of wave 3 of (3). It could also be filling out a larger degree ABC diagonal as well so I have added that potential count to the longer term chart as well.

Harmony Gold Mining (HMY)

HMY was last covered in Surf Report 4.1 when we first covered the SILJ. The red “up and to the right arrow” has remained valid since the lows of September 2022. While we could still see a larger 5-degree Primary wave structure fill out, I believe its also plausible to expect that an ABC diagonal could also be a potential for the larger degree count. Right now, HMY appears to be completing a 3-wave Intermediate (A) wave and in particular, a 5-wave Minuette degree structure is completing within Minor degree C of (A).

Buenaventura (BVN)

Like PAAS, we also reviewed BVN in the previous Surf Report. As not much has changed in the larger degree structure, for this report we’ll zoom in and look at the smaller degree waves on the 144-min chart. Price is now pulling back in wave (iv) of 3. Its interesting that the 38.2% Fib retracement which is a typical retracement level for many wave 4s sits right near the lower trendline of the price channel that’s developed. Remember that it certainly doesn’t need to fall that deep. We are looking for a MACD reset which has already occurred with a full corrective structure in place. Really clean waves to surf here in my view.

Evolution Mining (EVN.ASX)

Nothing has changed since Surf Report 2 in the larger degree structure in Evolution Mining. I did add counts for a very large ABC diagonal in the Primary degree in yellow. EVN has a nice 1-2 Minor degree structure forming and forming a nice little inverse head and shoulders around the February 2024 low in 2. We should expect a powerful wave 3 thereafter inside Intermediate (1) or (A) if its filling out a diagonal.

Industrias Peñoles S.A.B De CV (PE&OLES.MX)

Theo only updates to Industrias Peñoles I’ve made is to how I’m counting the Primary structure. Given the rally spanning from 2005-2012 was 3 waves, I believe it counts best an Primary A wave with Primary wave B ending during March 2020. We then would expect a 5-wave Intermediate degree rally to fill out a Primary C wave that can take years to finish. Price attempted to breakout of the downtrend in April 2024 and will likely try again in the near term which would in turn breakout of Intermediate degree Fib resistance.

Endeavour Mining (EDV.TO)

Endeavour Mining was reviewed in Surf Report 2 as well and was an outlier in that the Primary wave 2 was initially considered to struck in October 2022. However, unlike Evolution Mining and other junior gold miners, the low did not hold. Instead price rallied in a larger Intermediate (B) wave bounce before finally finding the Primary wave 2 low in February 2024.

So what did we get wrong with identification of the Primary Wave 2 low in Surf Report 2? Let’s use this opportunity to learn by zooming into the 144 min chart below. As you can see the rally following the October low did not have a full 5-wave structure or extend up to the 1.00 level from the March 2023 low. Finally price broke down below the 0.618-0.786 Fib support zone in an impulsive fashion. Those missing ingredients combined broke the bullish setup and failed to confirm the low. As we can see, price continued to weaken into the low achieved in February 2024. So with that lesson learned, we now know what to look for to confirm the February low with the ideal Minor degree structure presented in green. One can see the bullish inverted head and shoulders forming so that would also be bullish to pattern chart trades. lets see how wave 2 proceeds and if it can hold expected Fib support in corrective fashion.

Summary

I hope you enjoyed this Surf Report and perhaps learned something new. Again these charts for junior gold miners are indicative of a larger uptrend taking shape in the precious metals and mining sector with many in the early stages of a Primary degree wave 3 (or perhaps an upward moving Primary C wave in some cases). The major lows of late 2022 have held for most of miners reviewed in this report and although some smaller degree consolidation waves are now underway, the good waves are looking to continue. The next report will begin reviewing the waves within the SILJ ETF. Then we’ll circle back to the GDX for the next grouping within that ETF. It will take a few round trips to cover all of the holdings within these ETFs but as you can tell from many of the longer term charts the “Endless Summer” in Precious Metals and Miners seem to be in its earliest days.

Until next time…

Cheers and #EndTheFed!

-Hypersonic78

Disclaimer: None of this is financial advice! Please do your own diligence. The views expressed here and other Surf Reports are my own. Only risk what you can afford to lose in these crazy markets. Know your timeframes, parameters, and personal risk tolerance.

Position Disclosure: I remain long physical silver and gold (mostly silver) and am long a handful of individual precious metals mining shares (but none included in this particular report).

Keep reading with a 7-day free trial

Subscribe to Hypersonic Elliott Wave Surfer to keep reading this post and get 7 days of free access to the full post archives.